The order-to-cash (O2C)1 process is the lifeblood of all companies. The O2C process covers everything from receiving an order (whether for a physical product, digital subscription, pay-per-use service, or a mix thereof), fulfilment of your customer’s wishes, and receiving payment.

A well-oiled O2C process is accurate, scalable, and requires little manual effort. Conversely, subpar processes wreak havoc on a company’s bottom line and reputation.

As O2C processes touch multiple functions and departments, it makes organization-wide alignment a top priority. In addition, companies are under pressure to adapt their processes to new business models such as subscription or usage-based pricing. Unfortunately, the legacy tools that many companies rely on are often unfit for this purpose.

But fortunately, there is a solution that simplifies the O2C process flow enormously and leaves plenty of scope for new business models: the automation of order-to-cash processes.

In this article, we outline the 5 key benefits of automating O2C processes and how you can benefit from implementing a smart order-to-cash platform that lifts your company’s business to the next level – eliminating errors, boosting customer satisfaction, bringing new digital business models to the market, and improving your revenue streams to a great extent.

Table of Contents

The 5 benefits of order-to-cash automation

O2C automation makes life easier for both your employees and your customers. Its benefits are wide-ranging, impacting everything from companies’ efficiency and profitability to customers’ satisfaction.

Summary of the 5 benefits of order-to-cash automation:

- Increased efficiency

- Fewer billing and invoicing errors

- Higher customer satisfaction

- Greater profitability

- Improved employee experience

Now let’s outline in detail what the 5 major benefits of automating your order-to-cash processes are:

1. Increased efficiency

Traditionally, employees have had to contend with legacy accounting systems that don’t communicate with one another. Or the legacy systems lack the necessary features to accomplish order-to-cash tasks. This results in several challenges.

Staff must manually switch between tools and convert siloed data from one software to another. Employees basically must act as human application programming interfaces (APIs). And when you consider how many systems are used in the O2C process, it’s easy to see the scale of problems regarding effort, lack of flexibility, and proneness to errors.

In contrast, the smart automation of O2C processes ensures that efficiency problems are solved. An order-to-cash platform brings together all systems involved in the process at a central point. With the help of modern APIs, data transfer between departments, systems, and books of business can be automated and data silos are dissolved.

It also automates manual tasks such as contract management, billing and invoicing, revenue recognition, payments, and dunning. This means that employees no longer have to waste valuable time that could be invested in growth projects.

Best of all, automation-based O2C processes are inherently scalable. You can boost efficiency without increasing your staffing needs or your team’s workload.

2. Fewer mistakes

Fragmented order-to-cash processes create errors. This is no surprise when your employees have to manually intervene at every step of the O2C process, especially when the number of transactions is in the millions.

Unfortunately, a single typo could mean you invoice the wrong product to the wrong customer—or bill for less than your business is owed. This is exactly where automation plays a crucial role.

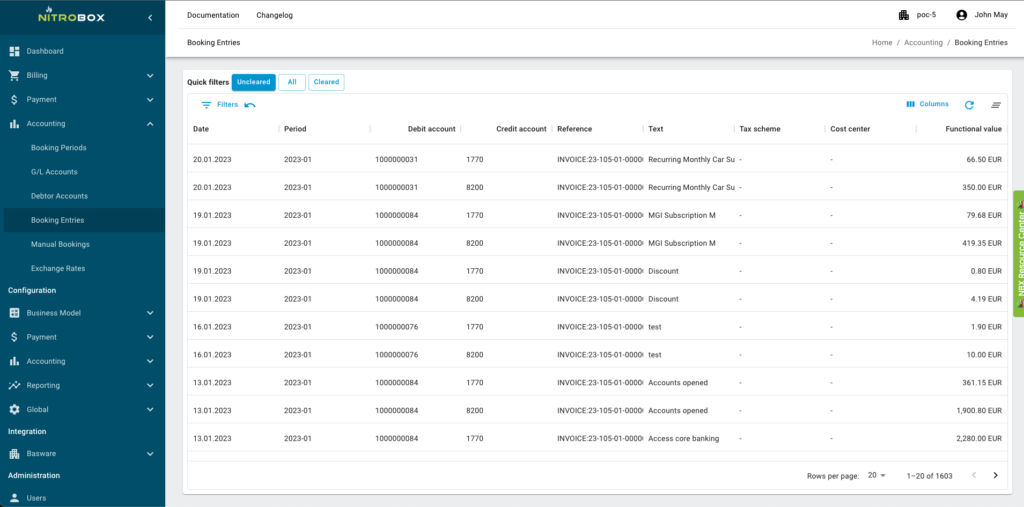

Automated O2C processes transfer data directly between your systems from order to billing, invoicing, payment matching, and delivery – avoiding unnecessary errors and ensuring a smooth workflow.

3. Higher customer satisfaction

Mistakes, delays, and a lack of transparency erode customer satisfaction. Today’s consumers expect their experience to be seamless—a single mistake could erode their trust in your brand and result in losing a potential customer or churning a loyal one.

However, thanks to order-to-cash automation, companies are able to ensure a first-class customer journey if handled correctly. The mix of a smooth O2C process and professional customer service ensures a successful buying experience, resulting in high customer satisfaction and good customer retention.

For example, self-service portals for customers let them take control of their own buying journey. When they click ‘buy’, they instantly receive an order confirmation email, a link to track their order status in real-time, and an accurate invoice.

Best of all, their order is processed and fulfilled quickly. If they need help, the customer support team can be on call to handle cases where self-service inevitably falls short. Order-to-cash automation isn’t about automating everything, it’s about automating the tedious, nerve-wracking tasks that are error-prone due to sheer volume.

4. Greater profitability

Streamlining the O2C process with automation reduces the time a business takes to receive payment, improving its cash flow. BCG found that these types of O2C transformations can deliver:

1-3% revenue increase

15-30% cost savings

30% decrease in DSO

What impact would this have on your organization’s bottom line?

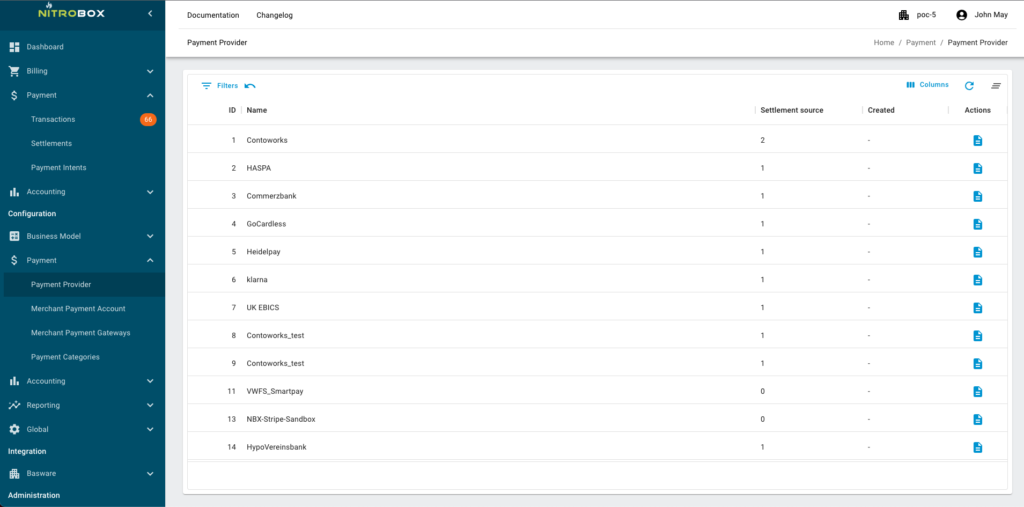

Apart from that, smart order-to-cash platforms also enable a short time-to-market for new digital business models that further boost your revenue and make your stakeholders happy. This makes it easy to connect a wide range of payment providers and payment options, reach more customers, and further increase sales.

5. An enhanced employee experience

Let’s close on a less growth-oriented note. Rather, a morale-oriented one. Your employees want to focus on creative work that engages and challenges them. Manual data entry is neither. Nor is spending all day, every day switching back and forth between various disconnected order-to-cash tools. Order-to-Cash process automation will boost the morale and productivity of your finance and accounting teams2. Engaged, content employees are going to be significantly more productive than those bored out of their minds. Automating your O2C processes frees your team from routine, mundane tasks. Never again will they have to manually spread siloed data from one system to another or create customer invoices from scratch. Instead, they can work on more valuable and strategic work. This will have a hugely positive impact on your employee experience. If you want to learn more about how smart O2C automation can take the growth and scaling of an international company to a new level, the success story of Oviva and Nitrobox is a very nice practical example.Transform your billing into a successful O2C process

As we have seen in this article, the benefits of a seamless, automated O2C process are felt across all areas of a business and are critical to a company’s success. Just as important, however, is the realization that a smooth O2C process is not only possible but also within reach.

Nitrobox’s order-to-cash platform was designed to help companies increase the scale and efficiency of their O2C processes with automation and achieve their potential through smart technology. It provides all order-to-cash capabilities in one central platform ranging from contract management, billing and invoicing, and revenue recognition to payments and dunning.

Designed as a smart SaaS technology, it can be easily integrated into your already existing IT infrastructure via API. The same goes for connecting payment providers to the Nitrobox order-to-cash platform. It enables you to offer exactly the payment options your customers love.